The financial sector is getting more popular driven by the rise of fintech.

(source)

Financial technology leverages innovation to deliver financial services.

This has led to a more dynamic and accessible financial landscape for consumers and businesses.

But here’s the thing: with all this growth comes responsibility and regulatory compliance.

Fintech companies need to stay on top of changing rules and regulations to keep everything legit.

In 2024, the demand for fintech solutions is reaching new heights.

Beyond individual consumers seeking convenient and secure financial tools, businesses of all sizes are increasingly turning to fintech to facilitate their financial operations.

In this blog, we’ll discuss 15 key fintech trends shaping the financial industry in 2024.

We’ll see how these trends affect digital banks, financial institutions, businesses, and consumers and what the future holds for this changing industry.

The Projected Growth of the Fintech Industry

(source)

Analysts predict remarkable growth for the US fintech industry in the coming years.

One of the hottest segments within fintech is the Digital Assets market. Experts anticipate total Assets Under Management (AUM) to reach a staggering US$36.88 billion by 2024.

This translates to an average AUM per user of roughly US$420.20, highlighting the significant value individuals entrust to this space.

Moreover, the Digital Assets market is poised for continued expansion, with analysts predicting a revenue growth of nearly 18% in 2025.

Beyond Digital Assets, the Digital Payments market is another area experiencing significant user adoption.

(source)

The number of users will climb to 344.8 million by 2028. This signifies a growing preference for convenient and secure digital payment methods.

The takeaway? Fintech is no longer a fringe concept but a rapidly growing force reshaping the financial industry. Consumers are demanding innovative and accessible financial solutions.

So, let’s see what trends fintech institutions and companies must follow to capitalize on this exciting opportunity.

Customer Needs in the Financial Sector

Fintech consumers crave convenience, control, and a seamless experience. This is driving a wave of innovation in fintech, with new trends emerging to meet these evolving needs.

- Demand for Integrated Experiences: Customers today crave seamless experiences. They want their financial tools to be integrated with the services they use every day, eliminating the need to jump between multiple apps and platforms.

- Rise of Openness: Regulatory changes like PSD2 (Payment Services Directive 2) and open banking initiatives push the financial industry towards greater openness. These regulations mandate that banks provide secure access to customer data through APIs (Application Programming Interfaces).

- Technology Adoption and Modular Thinking: Businesses increasingly view financial services as just another component they can integrate into their user experience rather than something they need to build themselves. This modular approach makes embedded finance even more attractive, as companies can leverage pre-built solutions from fintechs and banks.

- Evolving Trust Landscape: The trust landscape in financial services is significantly shifting. While traditional banks still hold a strong position, fintechs are gaining traction, particularly among younger generations.

What are the Fintech Trends for 2024?

Let’s look at 15 key trends that are a direct response to customer demands for a more integrated, open, and user-friendly financial experience.

1. Artificial Intelligence and Machine Learning (AI/ML)

(source)

Fintech companies use AI and machine learning technologies to analyze data, identify patterns, and automate processes.

Here’s how AI/ML is making a splash in fintech:

- Personalized financial experiences: AI can analyze users’ financial habits and spending patterns to offer customized recommendations for budgeting, saving, and investment opportunities. Imagine an AI assistant suggesting ways to reduce unused subscriptions or recommending a savings plan tailored to your financial goals.

- Enhanced fraud detection: AI algorithms can analyze transactions in real-time, identifying suspicious patterns that might indicate fraud. This helps financial institutions protect their customers’ hard-earned money. For instance, AI can detect unusual spending patterns or attempts to access accounts from unfamiliar locations.

- Automated loan approvals: AI can streamline the loan application process by analyzing borrowers’ financial data and creditworthiness to make faster and more informed lending decisions. This can benefit borrowers and lenders by speeding up the process and potentially offering access to credit for underserved populations.

(source)

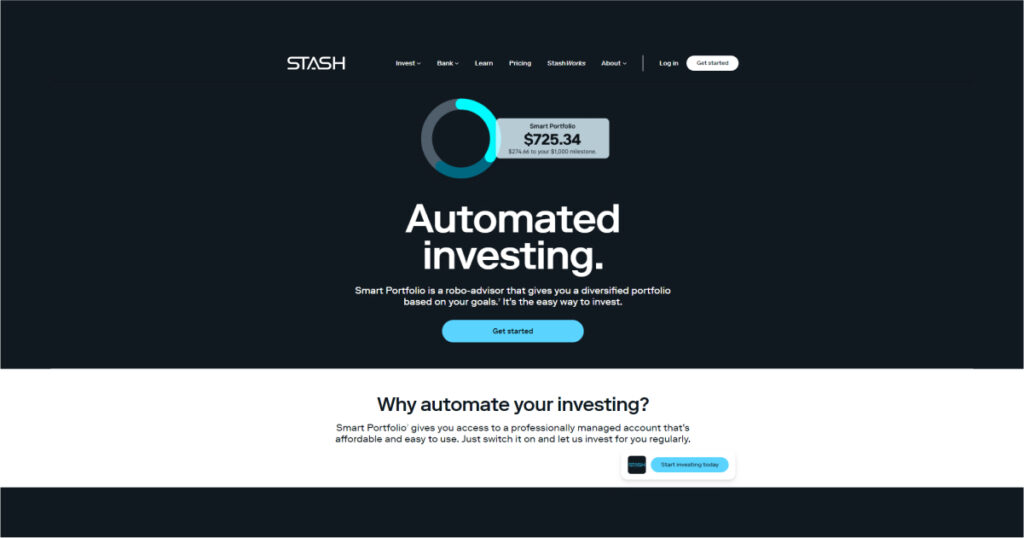

For example, Stash, a US-based micro-investing platform, is a prime example of how AI is used to personalize the investment experience through their robo-advisor, Stash Smart Portfolio.

Leveraging AI, Stash gathers users’ financial goals and risk tolerance through a questionnaire.

(source)

Based on this information, their AI technology builds and automatically manages diversified investment portfolios tailored specifically for users.

Stash’s AI acts as a personal investment guide, helping users invest confidently even without being a financial expert.

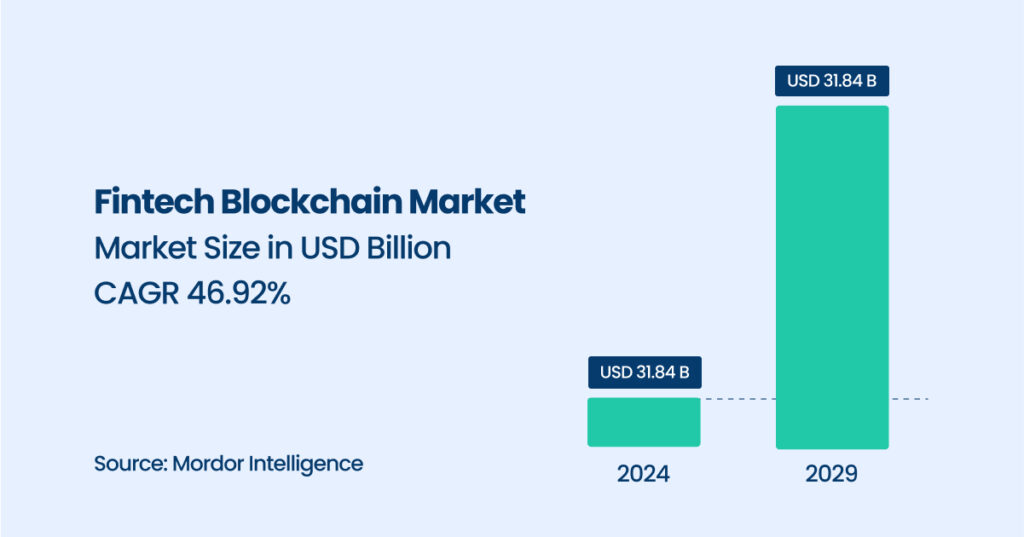

2. Blockchain Integration

(source)

Blockchain technology in the financial services industry promises a super secure and transparent record-keeping system for money.

Here’s how this tech is making waves in financial services:

- Faster and cheaper transactions: Blockchain can streamline cross-border payments, potentially reducing fees and processing times. Imagine sending money to family overseas quickly and securely without hefty bank charges.

- Improved security: Blockchain’s secure design makes it difficult for fraudsters to tamper with financial records. This can give financial institutions and users greater peace of mind about their money.

- New financial products: Blockchain paves the way for innovative financial products. For instance, it could be used to create more efficient supply chain financing or even facilitate the trading of digital assets like cryptocurrencies.

3. Embedded Finance

(source)

Embedded finance is one of the hottest fintech trends where financial services are seamlessly integrated into non-financial apps and platforms.

Embedded finance solutions are projected to exceed the combined worth of fintech startups and the top 30 global banks and insurance firms.

Embedded finance is the solution for consumers craving convenience as they don’t have to waste time at banks.

This fintech innovation benefits both businesses and consumers:

- Convenience for Users: There’s no need to juggle multiple apps or visit a bank branch for banking services.

- New Revenue Streams for Businesses: By offering embedded financial tools, companies can attract and retain customers, potentially creating new revenue streams.

- Emerging Tech Powerhouse: Embedded finance leverages emerging technologies like APIs (Application Programming Interfaces) to connect different platforms and services seamlessly. This opens doors for even more innovative financial solutions in the future.

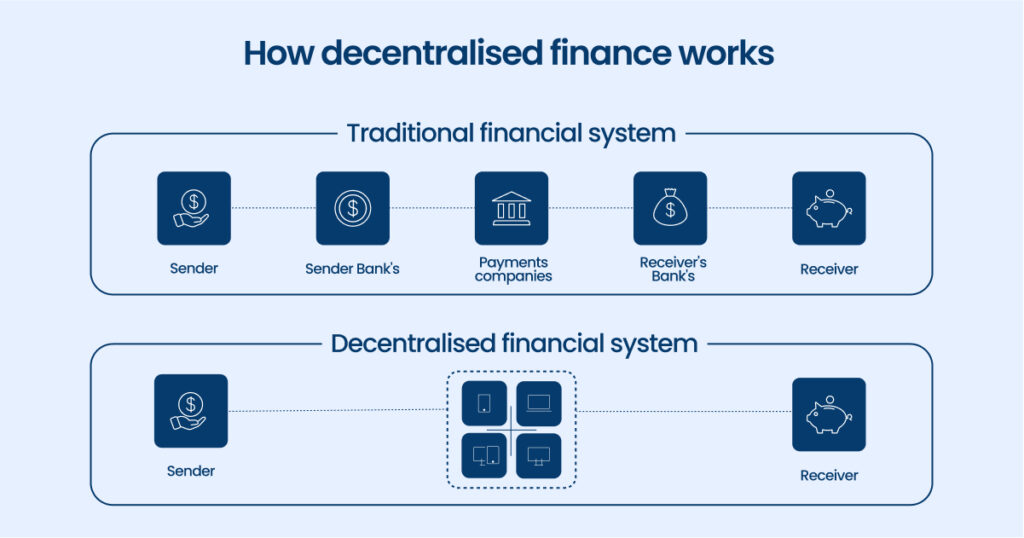

4. Decentralized Finance (DeFi)

While connected to the cryptocurrency market and alternative investments, DeFi offers a whole new way to manage finances.

DeFi allows users to borrow, lend, and invest directly with each other, cutting out the traditional banks.

Here’s why DeFi is a trend to watch in fintech:

- More Financial Inclusion: DeFi has the potential to provide financial services to people who are currently excluded from traditional banking systems. This could be especially helpful for those with limited credit history.

- Greater Control for Users: DeFi gives users more control over their money. They decide where to invest their savings and what interest rates they want to earn.

- Potential for Innovation: DeFi is a rapidly growing space, opening doors for innovative financial products and services that we can’t even imagine yet!

It’s important to note that DeFi is still in its early stages and comes with some risks, like the volatility of cryptocurrencies and the potential for scams.

5. Open Banking

(source)

Imagine a world where your fintech app can securely access a user’s bank account information, with their consent, of course! This opens doors to a wealth of opportunities:

- Improved Product Development: Fintech institutions can leverage open banking data to develop more personalized and targeted financial products and services. This could include anything from customized savings plans to AI-powered budgeting tools.

- Streamlined Customer Onboarding: Open banking can simplify the customer onboarding process. By accessing relevant bank data, companies can potentially pre-fill applications and expedite account verification, saving time and friction for both parties.

- Stronger Risk Management Tools: Open banking data can be used to develop more sophisticated risk assessment models. This allows fintech companies to make better lending decisions and potentially offer more competitive rates to qualified borrowers.

Open banking also fosters collaboration between traditional banks and fintech companies.

Fintechs can leverage open APIs (Application Programming Interfaces) to securely access customer data with permission, creating a more integrated financial ecosystem.

Companies like Plaid, a San Francisco-based payment platform, already use the potential of the open banking industry.

Plaid’s platform allows users to securely share their data with authorized fintech apps, fostering a more connected financial ecosystem.

This empowers fintechs to develop innovative solutions by leveraging open banking data.

Plaid’s technology helps power over 8,000 fintech apps, including popular names like Venmo and Robinhood.

6. RegTech (regulatory technology)

The financial sector is entire of rules and regulations, and keeping up with them can be challenging.

That’s where RegTech comes in. RegTech is a powerful tool that helps fintech firms manage compliance more efficiently and automatically.

Imagine having software to help you identify relevant regulations, monitor your activities for compliance, and even automate reporting tasks. Here’s how RegTech benefits fintech firms:

- Reduced Costs: Manual compliance processes can be time-consuming and expensive. RegTech tools can streamline these processes, saving fintech firms time and money.

- Minimized Risk: Compliance failures can lead to hefty fines and reputational damage. RegTech helps minimize these risks by ensuring fintechs stay on top of regulatory requirements.

- Faster Innovation: By automating tedious compliance tasks, RegTech frees fintechs to focus on their strengths: developing innovative financial products and services.

7. Big Data and Analytics

Big data and analytics are transforming the way financial services are delivered.

This data can be used to:

- Personalize Financial Products: With a deeper understanding of customer needs and behaviors, fintech firms can develop personalized financial products and services. This could include anything from targeted investment recommendations to budgeting tools tailored to your spending habits.

- Make Smarter Decisions: Data analytics empowers financial institutions to make data-driven decisions. They can assess risk more effectively, optimize pricing models, and even predict potential fraud attempts.

- Identify New Opportunities: By analyzing trends and patterns in financial data, companies can develop innovative solutions to meet growing customer needs.

8. Cybersecurity

Digital banking is booming, but with convenience comes a responsibility to keep users’ financial information safe.

That’s where cybersecurity advancements in the financial system come in.

How these advancements benefit the fintech industry:

- Enhanced Protection for Companies: Fintechs are constantly developing new data security measures to combat the threats. This includes stronger encryption, advanced fraud detection tools, and artificial intelligence (AI) that can identify suspicious activity.

- Peace of Mind for Users: Knowing their financial data is protected gives users peace of mind. Advancements in cybersecurity help ensure their money and personal information are secure when using digital banking services.

- A More Trusted Financial Ecosystem: By prioritizing robust cybersecurity, companies can build trust with users and create a more stable financial ecosystem for everyone.

9. Gamification

Financial literacy and responsible money management are crucial, but traditional methods can be dry and uninspiring.

Gamification is another fintech trend that injects a dose of fun and competition into financial services.

Here’s how gamification can be a game-changer:

- More Engaged Users: Gamification techniques like points, badges, and leaderboards can significantly boost user engagement with financial apps. Imagine users competing with friends for the highest savings rate or earning points to complete budgeting challenges.

- Healthy Financial Habits: Gamification can nudge users toward responsible money management by rewarding positive financial behavior. Earning points for reaching savings goals or completing educational modules on budgeting can incentivize healthy financial habits that stick over time.

- More Loyal Customers: Gamification creates a sense of enjoyment and accomplishment around financial management, fostering long-term loyalty towards the fintech company.

10. Video Banking

Video banking is one of the hottest fintech trends, putting a human face back into digital banking.

Users can securely video chat with a bank representative directly from their phone or computer.

Video banking provides a more personal touch compared to traditional online banking.

Customers can connect with a real person, ask questions, and receive advice from the comfort of their own homes.

For fintechs without a physical branch network, video banking offers a way to provide a more personalized service..

11. Buy Now, Pay Later (BNPL)

The concept of BNPL is a growing trend in the finance industry.

It allows customers to split the cost of a purchase into smaller, more manageable installments.

Here’s how BNPL is impacting the financial landscape:

- Boosts Sales for Businesses: Offering BNPL options can potentially increase sales by making businesses’ products more accessible to customers who might not be able to afford the full price upfront.

- Convenience for Consumers: BNPL provides a convenient way for consumers to manage their finances. They can spread out the cost of purchases and avoid the burden of high-interest credit card debt.

12. Biometrics

The password era is nearing its end.

Fingerprint scans, facial identification, or even iris scans replace password logins for secure account access and transaction approvals.

Biometrics offers a significant security upgrade compared to traditional passwords, as physical or behavioral traits are hard to replace.

Biometric authentication can be layered with security measures like PINs or one-time codes to create a robust multi-factor authentication (MFA) system.

This provides an additional layer of defense against unauthorized access attempts.

13. Virtual Bank Cards

The traditional banking industry is getting a digital makeover with virtual bank cards.

These digital cards reside within a phone’s wallet app, offering several advantages for both fintech and customers:

- Improved Security: Virtual cards can be instantly disabled if compromised, minimizing financial losses due to fraud. Additionally, features like single-use cards or merchant-specific restrictions provide an extra layer of security.

- Reduced Costs: Issuing and managing virtual cards is significantly cheaper than physical cards. This translates to potential cost savings and the ability to offer virtual cards as a free or value-added service for bank accounts.

- Convenience and Accessibility: Virtual cards are always accessible on your phone, eliminating the worry of forgetting your physical card. They can be used for online and in-store transactions via NFC technology, offering seamless payment experiences.

- Improved Spending Control: Virtual cards can be pre-loaded with specific amounts, allowing users to manage their budgets better and control online spending habits.

Leading neobanks, like Revolut, leverage virtual cards to empower customers with immediate payment functionality.

This allows users to conduct P2P transactions, in-app purchases, and online payments even before receiving their physical card.

14. Green Fintech

Environmental consciousness is rising, and the financial sector is taking note.

Green fintech, a rapidly growing trend, focuses on developing financial solutions that promote environmental sustainability.

Two key factors drive this trend:

- Consumer Demand: Over half of global consumers are increasingly concerned about environmental issues. This means they’re more likely to choose financial institutions that align with their values.

- Investor and Regulatory Pressure: When evaluating companies, sustainability is becoming a major consideration for investors and regulators. Fintech firms that embrace green practices can attract more investment and operate with greater regulatory ease.

Here’s how green fintech is transforming the financial landscape:

- Sustainable Investment Products: Green fintech firms are developing innovative investment products focusing on environmentally friendly sectors like renewable energy or sustainable agriculture.

- Carbon Footprint Tracking and Reduction: Fintech solutions are helping financial institutions and their customers track and reduce their environmental impact. Imagine tools that analyze spending habits and suggest ways to reduce your carbon footprint or apps that connect businesses with eco-friendly suppliers.

By embracing green fintech, companies can:

- Attract Socially Conscious Customers: Demonstrating a commitment to sustainability resonates with a growing population segment.

- Meet Investor and Regulatory Demands: Green practices can position a company favorably for investment and ensure compliance with evolving regulations.

- Contribute to a Positive Environmental Impact: Fintechs can build a more environmentally responsible future by promoting sustainable finance.

15. No-Code and Low-Code Development

Building custom fintech solutions requires a team of skilled programmers.

But here comes a game-changer: no-code and low-code development platforms.

Imagine building basic financial apps or workflows without writing a single line of code!

These platforms use drag-and-drop interfaces and pre-built components, making it easier for businesses to create innovative financial tools.

Here’s how no-code and low-code development are shaking things up:

- Faster Development Cycles: Building fintech solutions with no-code or low-code tools is significantly faster than traditional coding methods. Businesses can test and iterate on ideas quickly, quickly bringing innovative solutions to market.

- Empowering Non-Technical Teams: These platforms don’t require extensive coding knowledge. This allows non-technical teams within fintech firms to develop basic tools and workflows, streamlining internal processes or creating user-facing features.

- Reduced Development Costs: No-code and low-code platforms can potentially reduce development costs compared to hiring a team of programmers. This makes it more accessible for smaller fintech firms or startups to build custom solutions without breaking the bank.

No-code and low-code development aren’t a magic bullet, and complex applications might still require coding expertise. However, these platforms offer a powerful tool for fintech firms to:

- Increase Innovation Speed: Rapidly prototype and test new ideas, accelerating the development of innovative financial solutions.

- Empower Business Teams: Allow non-technical teams to build basic tools and workflows, fostering greater collaboration and agility.

- Reduce Development Costs: Lower development expenses by building in-house solutions with user-friendly tools.

Partner with a Fintech Marketing Agency like [A] Growth Agency

By understanding these trends and partnering with a growth marketing agency specializing in fintech, you can ensure your financial institution stays ahead of the curve and delivers the exceptional user experience that today’s customers demand.

As a fintech growth marketing agency, we understand the changing needs of digital customers.

We work with neobanks, credit unions, and big banks to create data-driven marketing plans.

Here’s how we can help:

- Make Your Neobank Stand Out: We’ll help you build a strong brand, attract early adopters, and compete well in online banking with targeted ads.

- Connect with Credit Union Members: Our strategies help you engage with members, promote your services, and stay relevant in the credit union world.

- Keep Big Banks Ready for Tomorrow: We’ll create marketing plans that keep you visible, attract new customers looking for digital services, and set you up for success in the digital age.

Let’s discuss how we can create a winning marketing plan for your financial business!