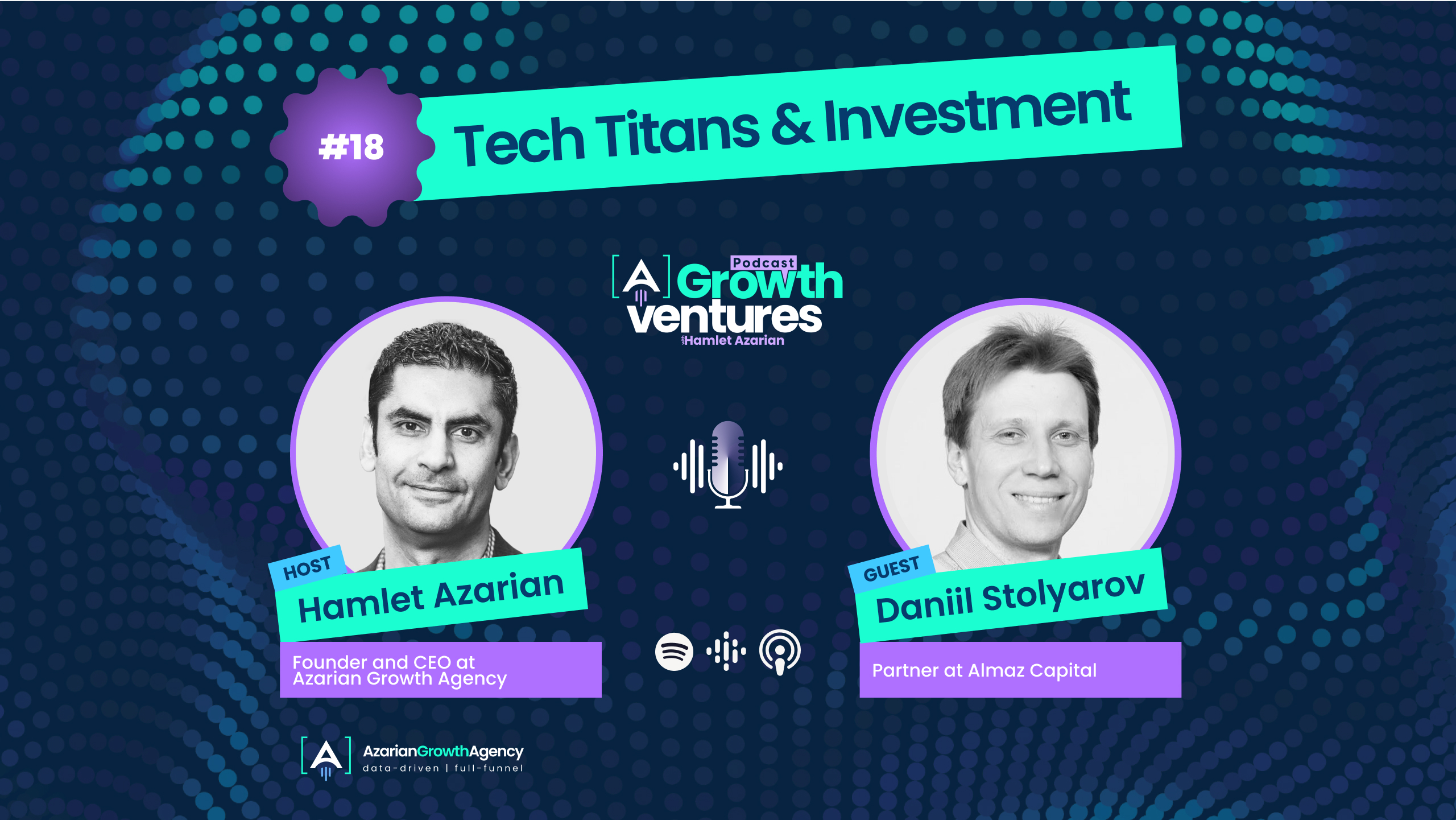

Scaling, bridging, and building future tech champions from East to West — Daniil Stolyarov’s insights redefine how founders should think about global growth and exits.

In today’s episode of the [A] Growth Ventures Podcast, Hamlet Azarian sits down with Daniil Stolyarov, Partner at Almaz Capital, to uncover lessons from his journey across investment banking, venture capital, and M&A advisory. From building a venture bridge between Eastern Europe and Silicon Valley to engineering billion-dollar exits, Daniil shares powerful advice on how to think globally from day one.

What We Explored with Daniil Stolyarov

Early Career Lessons: Investment Banking Foundations

Daniil reflects on how starting his career at ABN AMRO and Lehman Brothers in Tech M&A taught him how to think about industries at scale — and why understanding market dynamics is crucial to long-term investment success.

The Genesis of Almaz Capital: Bridging Two Worlds

Learn how Almaz Capital was born with backing from Cisco Systems to bring Silicon Valley venture-building standards to Central and Eastern Europe, focusing on globally scalable B2B startups.

The Rise of Eastern Europe’s Startup Ecosystem

Daniil explains how the “Skype Effect” in places like Estonia seeded thriving ecosystems, and why today’s Eastern European founders are no longer just engineers — they are global entrepreneurs solving problems for worldwide markets.

Check out our recent podcast featuring Minas Apelian, on corporate venturing.

Building Global Teams: The True Advantages of International R&D

Beyond cost savings, Daniil dives into why companies with Eastern European R&D hubs can scale faster — leveraging depth of talent, supply pipelines, and an emerging culture of product innovation.

Startup Exits: M&A vs IPO Mindsets

Drawing from his decade in Silicon Valley investment banking, Daniil breaks down why most successful exits happen through strategic acquisitions, and how founders should think about M&A as an acceleration opportunity, not a fallback.

Case Study: How a Strategic Merger Led to a Successful IPO

Hear the story of MakeTime’s journey — how a smart merger with Xometry turned two fledgling manufacturing marketplaces into a powerhouse that went public — all in under six years.

Key Takeaways

1:45 – Danil’s Amro Bank Role

6:03 – Almast Capital Activity

12:50 – Success Stories

22:49 – Successful B2B Company Formula

26:00 – M&A Background

29:40 – Advice for Founders

33:40 – A Successful Acquisition

Final Thoughts

Daniil Stolyarov’s journey reveals powerful lessons for founders, investors, and operators:

Success today demands building not just companies, but bridges — scaling globally from day one and outpacing competition by moving faster and thinking bigger.

Ultimately, Daniil reminds us: venture capital is about more than funding — it’s about building ecosystems and guiding founders onto the world stage.

In a world evolving faster than ever, founders who embrace these principles will lead the next generation of global tech champions.

Connect with Daniil Stolyarov

You can reach Daniil via LinkedIn or by email at [email protected].

Learn more about Almaz Capital at almazcapital.com.

![[A] Growth Ventures - podcasts](https://src.azariangrowthagency.com/wp-content/uploads/2023/09/A-Growth-Ventures_logo.png)